Introduction

The stock market witnessed a significant turnaround today as the S&P 500 surged and the Dow Jones Industrial Average jumped over 450 points, marking a sharp rebound from one of the worst weeks of 2024. Investors, who were once grappling with uncertainty, saw renewed optimism as several factors helped push the market upwards. But what exactly caused this dramatic shift? Let’s dive deeper into the reasons behind today’s surge and what it means for the future of the market.

Recap of the Worst Week in 2024

Just a few days ago, the stock market was enduring its worst week of 2024. Persistent inflation concerns, interest rate hikes by the Federal Reserve, and mixed earnings reports from major corporations led to a steep drop in stock prices. Many investors were left wondering if the bull market was finally coming to an end.

Major companies like Apple, Microsoft, and Tesla saw declines, dragging down tech-heavy indices like the NASDAQ. The overall sentiment was bearish, with investors shifting to safer assets like bonds.

Understanding the S&P 500 Surge

Fast forward to today, and the S&P 500 posted a strong recovery, gaining several percentage points. What triggered this surge? The answer lies in a combination of better-than-expected economic data, calming inflationary pressures, and a slightly more dovish stance from the Federal Reserve.

Notable sectors that contributed to the growth included technology, healthcare, and consumer discretionary, all of which bounced back from last week’s slump. Investors are now eyeing these sectors for sustained gains moving forward.

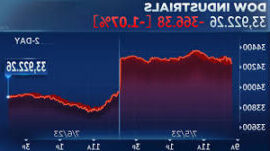

Dow’s Impressive 450-Point Jump

The Dow Jones Industrial Average saw a significant rebound, jumping over 450 points. This marks a pivotal moment for the index, which had been suffering from declines over the past few weeks.

So, what caused the surge? Positive earnings reports from companies like Boeing, Caterpillar, and Coca-Cola played a big role. Additionally, a slight dip in bond yields encouraged more investors to put their money back into equities, further pushing the Dow higher.

NASDAQ’s Recovery

The NASDAQ, home to many of the world’s biggest tech companies, also experienced a sharp recovery. After weeks of underperformance, major tech stocks saw renewed interest. Companies like Amazon, Nvidia, and Alphabet helped lead the charge, with tech investors showing signs of relief following concerns about rising interest rates.

Economic Indicators Supporting the Rebound

Several key economic indicators helped support today’s market rebound. For one, new inflation data showed a slight cooling, which eased investor fears about future rate hikes. Additionally, recent employment numbers were solid, indicating that the economy is still on firm footing.

Global Market Influence

It’s not just U.S. markets that rebounded today; global markets also played a part. Positive news out of Europe and Asia, particularly regarding inflation and trade, helped boost investor confidence across the globe.

Foreign policy and trade relations have a major influence on U.S. stocks, and today’s developments in these areas contributed to the overall market surge.

Investor Sentiment and Market Volatility

Investor sentiment shifted dramatically from bearish to bullish. The Volatility Index (VIX), often referred to as the “fear gauge,” dropped significantly, showing that investors are becoming more confident in the market’s future performance. This shift in sentiment is key, as it often dictates whether traders will buy or sell.

The Role of Earnings Reports

Another factor behind today’s stock market surge is positive Q3 earnings reports. Many companies outperformed expectations, boosting investor confidence.

Surprising performances from companies like McDonald’s, Microsoft, and ExxonMobil played a crucial role in turning the tide for the market. Investors are now closely watching upcoming reports for further signs of strength.

Sector-Specific Performance

In today’s rally, certain sectors outperformed others. The energy sector, buoyed by rising oil prices, saw strong gains. Similarly, financial stocks rebounded as banks and insurance companies posted better-than-expected earnings.

On the flip side, consumer goods and tech sectors also played a significant role, particularly in pushing the NASDAQ and S&P 500 higher.

Impact of Bond Yields on Stocks

One of the major drivers behind today’s stock rally was the slight decline in bond yields. Over the past few weeks, rising bond yields had caused a shift away from stocks. However, as yields dipped, investors moved back into equities, contributing to the sharp recovery in indices like the Dow and S&P 500.

The Future Outlook for the S&P 500, Dow, and NASDAQ

Looking ahead, analysts are mixed on the market’s future performance. Some believe that the worst is behind us, and the market will continue to rise as inflation cools and corporate earnings remain strong. Others warn that potential risks, including global economic slowdown and geopolitical tensions, could still pose challenges.

How Retail Investors Are Reacting

Retail investors, often considered the backbone of the market, have shown a strong appetite for stocks during today’s rally. Platforms like Robinhood reported an increase in trading activity, particularly in tech stocks.

Popular retail stock picks include Tesla, Nvidia, and Amazon, which have all rebounded sharply after recent declines.

The Role of Institutional Investors

Institutional investors have also played a significant role in today’s rebound. Large hedge funds and pension funds were active buyers, particularly in the tech and energy sectors.

Institutional strategy in a rebounding market often involves moving into sectors that have underperformed, which can provide additional tailwinds for specific industries.

Conclusion

Today’s market rebound marks a significant turning point after one of the worst weeks in 2024. The S&P 500, Dow, and NASDAQ all posted strong gains, giving investors renewed hope for the future. While risks remain, including inflation and global economic concerns, today’s rally shows that the market is resilient and capable of bouncing back from adversity.

FAQs

- What caused the stock market to rebound today? The market rebounded due to a combination of positive earnings reports, cooling inflation data, and a slight decline in bond yields.

- Which sectors contributed most to the market’s rise? Technology, energy, and financial sectors were among the strongest performers today.

- How did global markets influence U.S. stocks today? Positive news from Europe and Asia, particularly around inflation and trade, helped boost U.S. market sentiment.

- Will the stock market continue to rise? While today’s rally is promising, future performance will depend on economic indicators, inflation data, and geopolitical developments.

- What role did institutional investors play in the rebound? Institutional investors were active buyers, particularly in tech and energy sectors, which helped fuel today’s surge.